Grow with Toqio

Unlock scalable financial solutions that empower you to expand your offerings, optimize your distribution channels, and drive growth—all through a flexible, easy-to-use platform.

Partner providers you can work with today:

Overview

Explore how embedded finance can empower your business by creating a financial service marketplace tailored to your ecosystem. To get started, select your preferred format to dive deeper into our platform and discover how we can help drive your financial transformation.

Watch

Discover Toqio through a brief video with our VP of Product, Kunal Galav that walks you through how our platform works and some of its compelling core features.

Learn about Toqio

with Kunal Galav

Read

Explore our two-page guide to learn how Toqio’s innovative platform drives growth. We cover the key benefits, how the platform works, essential features, and representative solutions you can build to accelerate success.

Use cases we address

According to a recent McKinsey survey, approximately 44% of B2B organizations are adopting or intend to adopt embedded finance solutions in the next six months. Check out the use cases being explored today and the upside with Toqio.

Merchant network monetization

Tailored financial solutions like flexible payment terms and revenue-sharing models that make you a key partner.

Embedded fund distribution

Toqio enables streamlined disbursements through flexible options like digital wallets and issued cards.

What businesses are building on Toqio

today to unlock growth

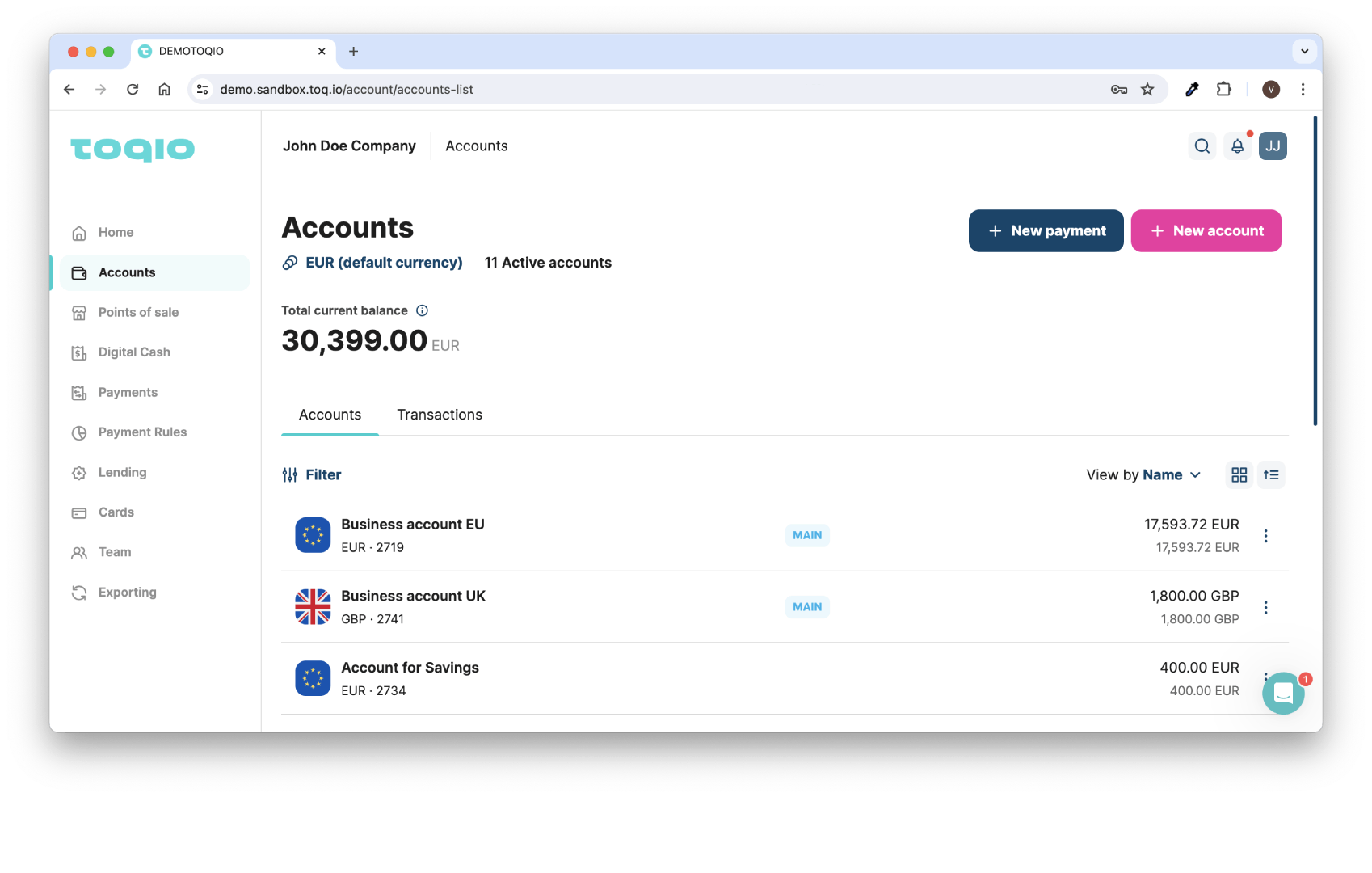

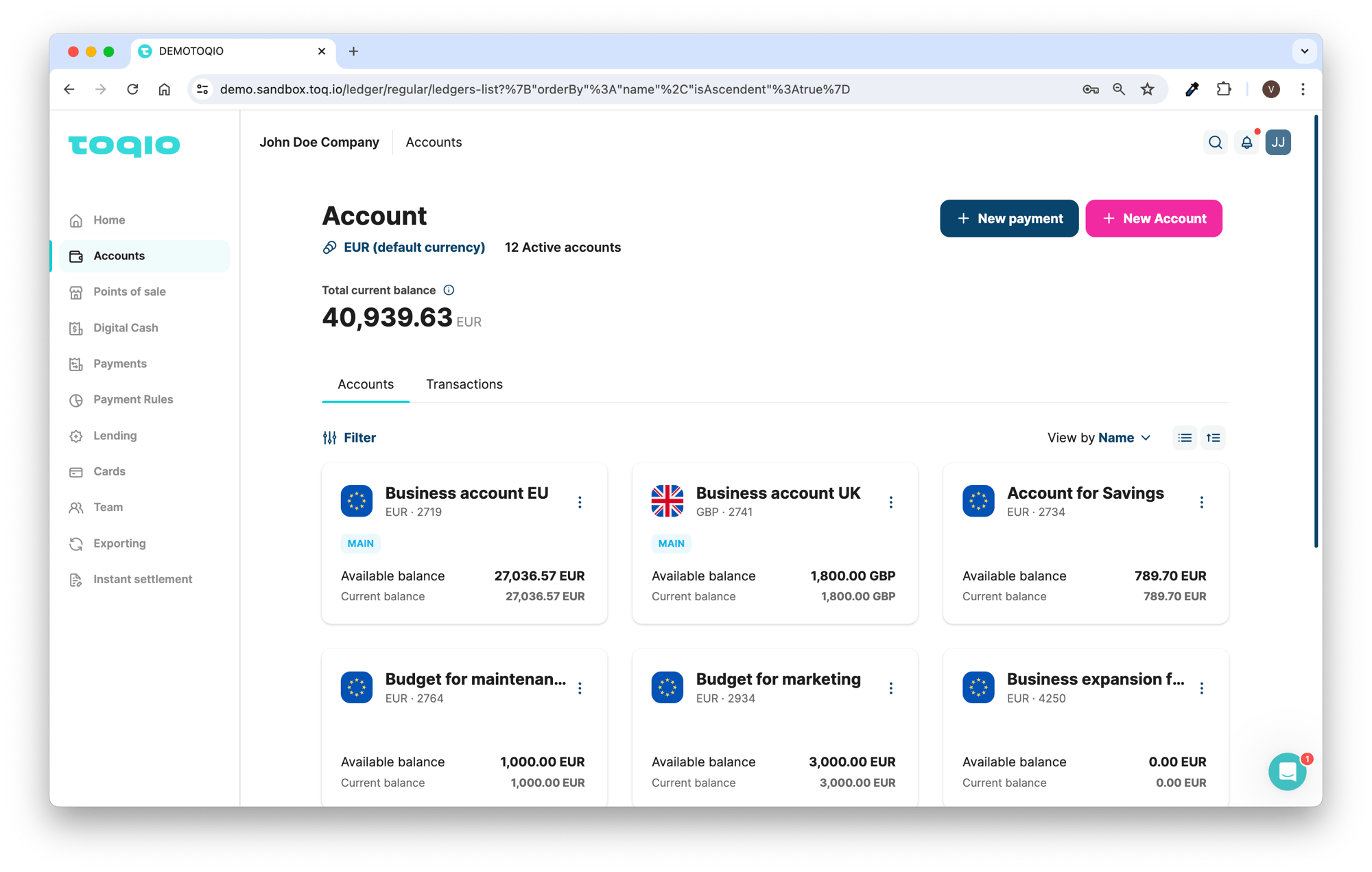

Fundamentally, we help our customers build complex financial products and solutions within their core offering to create a competitive edge and grow their business. We do this while helping you solve for working capital constraints and liquidity issues in your merchant networks, all on a single platform.

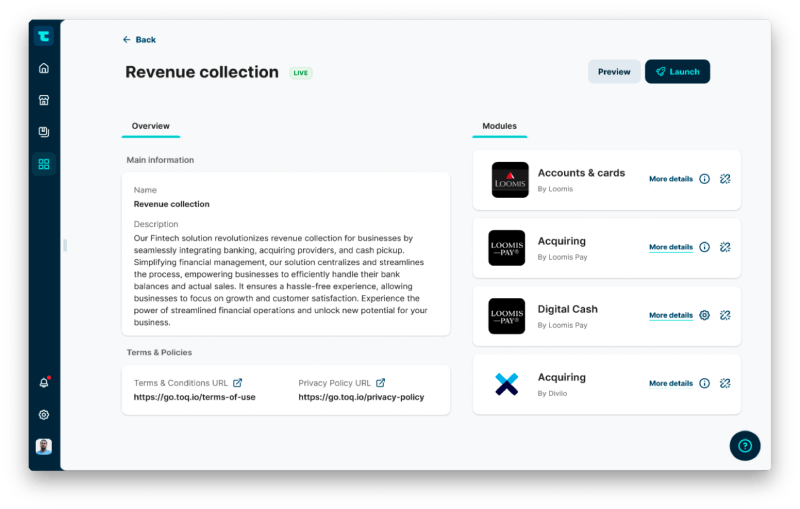

Revenue collection

Manage all your financial products in one place. Toqio lets you see everything on a single platform for total clarity: PoS, transfers, digital cash, and direct debit collections. Offer competitive financial products to merchants with greater negotiation power. Get clear insights on what’s selling and when, helping you make better business decisions.

Payment automation and reconciliation

Streamline payment collections and inter-account transfers from merchants, including cross-border transactions. Set custom rules for sweeps to ensure timely transfers and smooth reconciliations, improving cash flow, reducing errors, and efficiently managing global transactions. Easily integrate your CRM and ERP solutions and get the data insights you need.Advanced payouts

Toqio enables streamlined disbursements through flexible options like digital wallets and issued cards, allowing recipients to access and use funds immediately while keeping payments within the ecosystem.

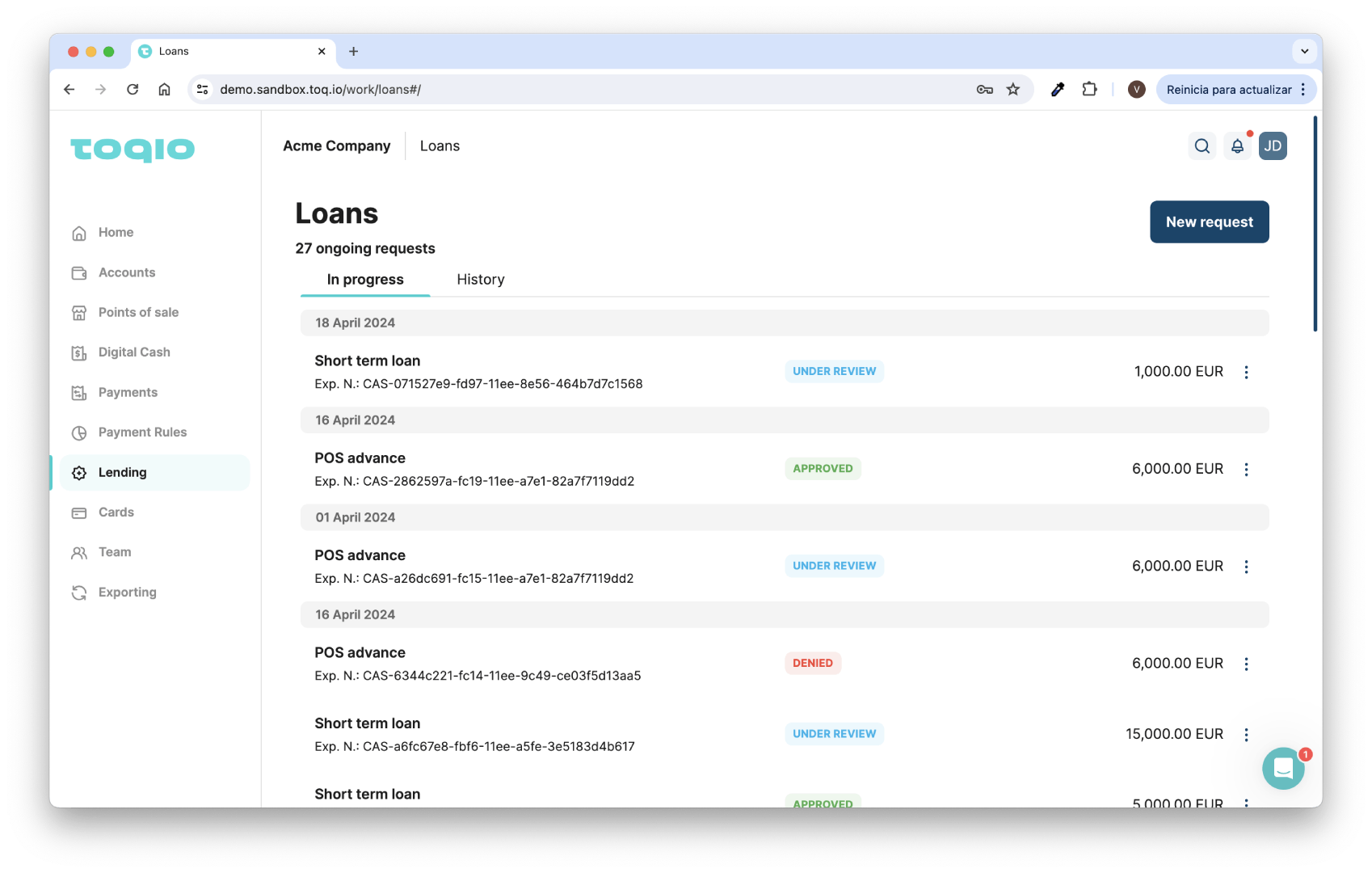

Merchant financing

Toqio enables corporates to integrate working capital solutions and flexible payment terms into their offerings, helping merchants manage cash flow more effectively. By offering financing, corporates support liquidity across their networks, creating a reliable and growth-oriented sales environment.Case studies

European brewery embarks upon new customer retention strategy

Learn how a customer launched a solution built on Toqio in just 16 weeks!

International logistics company optimizes liquidity in its distributor network

We provided help accessing liquidity to manage complex international financial relationships.

Embedded finance gains

Embedded finance is more than an efficiency play, it’s a growth tool.

Future proof your business and ecosystem

Create ongoing value drivers on our platform and get your customers and suppliers to spend and invest more with you.

Core revenue uplift*

Drive repeat and higher order values with your merchants and increase your share of wallet with access to superior products and multiple tier 1 bank and BaaS providers.

- Automated payables

- Automated receivables

- Flexible payment terms

5-8%

Revenue uplift

Core revenue uplift*

Drive repeat and higher order values with your merchants and increase your share of wallet with access to superior products and multiple tier 1 bank and BaaS providers.

- Automated payables

- Automated receivables

- Flexible payment terms

5-8%

Revenue uplift

Core revenue uplift*

Drive repeat and higher order values with your merchants and increase your share of wallet with access to superior products and multiple tier 1 bank and BaaS providers.

- Automated payables

- Automated receivables

- Flexible payment terms

5-8%

Revenue uplift

Challenges that limit distribution growth

Nearly 48% of corporates struggle with trapped liquidity, as key partners like merchants and distributors lack access to tailored financial products. This is largely due to the rigidity of services provided by traditional banks and neo-fintechs.

We've identified four major challenges where Toqio can provide clear solutions. Select the tabs to switch between challenges.

The challenge: You're likely facing challenges in creating standout offerings because it’s hard to leverage the data you collect from your network. Siloed systems might make that even more difficult. Without a complete view of your data, it's tough to meet your merchants' needs, like cash flow issues. This lack of clarity limits your ability to personalize offerings, meaning you miss potentially valuable growth opportunities.

The path to growth with Toqio: Easily offer custom financial products through Toqio. Integrate your ERP, CRM, or any data source to pull real-time insights, creating tailored solutions for your merchants. Configure workflows, set rules, and design personalized financial journeys, all without requiring technical expertise.

Toqio tools: Our orchestration hub lets you bring together different banking providers and multiple data sources in weeks.

The challenge: You might be facing limitations in your financial offerings because relying on a single service provider can hold you back. Being locked into one provider’s pricing and products makes it hard to adapt to specific regional needs or explore better options. This kind of banking dependency stifles innovation, limiting your ability to grow and stay competitive.

The path to growth with Toqio: Tap into pre-built financial and non-financial modules via Toqio’s marketplace of providers. You can also easily connect to existing or new partners if needed.

Toqio tools: Marketplace; configuration portal; low-code environment; financial product builder.

The challenge: If you're still using outdated, fragmented tools, it’s likely making your merchant journeys more complicated than they need to be. Managing multiple banking accounts for payroll, expenses, or leases without a centralized system adds unnecessary complexity. This scattered setup can reduce efficiency and lower adoption rates, holding back the full potential of your network.

The path to growth with Toqio: Simplify your complex user journeys on our platform. Effortlessly unite your business logic (by configuring payment flows, accounts, and cards) on one streamlined system. Toqio gives you the flexibility to create custom financial services tailored to your merchants’ needs, cutting through complexity and putting you in control of your growth.

Toqio tools: Orchestration hub; configuration portal.

The challenge: Implementing financial services can be costly and time-consuming for your business. You might be dealing with outdated technologies or locked into long-term agreements, making it harder to innovate. Integrating older systems with modern cloud platforms can also be a challenge. On top of that, high service and administrative fees from banks may be limiting your growth and flexibility.

The path to growth with Toqio: Cut down high implementation costs and timelines with Toqio’s API-first, cloud-native platform. Traditional setups can cost USD 150 million and take up to 30 months. Toqio lets you integrate banking providers in weeks. Customize notifications and messages to fit your business, all while saving time and reducing costs.

Toqio tools: Roster of market-leading implementation partners to create MVPs quickly; Toqio technology architecture.

Practical insights to help you drive results

Explore a curated selection of resources designed to help you delve further into growth strategies and opportunities.

Whether you're looking for quick tips or detailed analyses, you'll find the right tools to support your next steps.

Toqio: Your growth catalyst

Toqio empowers businesses to unlock growth with customizable, scalable financial tools. Deliver tailored or new financial solutions that drive revenue, strengthen customer connections, and adapt to your needs—all without complex integrations.

Get in touch to learn how we can help you grow today.

Did you miss our online Open House?

Watch the video to learn all about embedded finance as a growth driver,

with Toqio co-founder Mike Galvin.

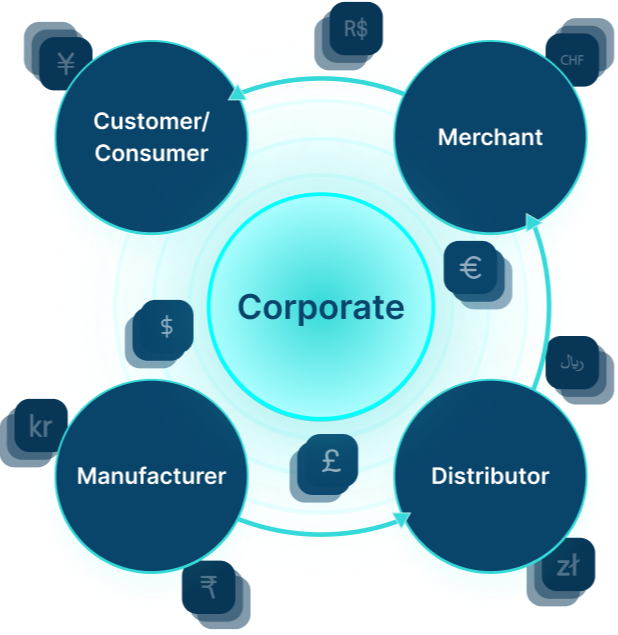

About Toqio

Toqio gives corporates access to financial tools that transform the value of their distribution networks for growth, efficiency, and resilience. We’re not turning corporates into banks, just enabling them to become the nexus between their merchants and financial institutions looking for new opportunities, unblocking the flow of capital, improving liquidity, and creating new and ownable financial channels in their networks.

We believe that with the right partner, corporates can tap the full potential of embedded finance on a fully configurable orchestration platform, harnessing the massive possibilities for growth lying dormant in their merchant networks.

Inducted into the Visa Innovation Program Europe

2024

Oracle NetSuite Rising Star

Deloitte UK Technology Fast 50 Award

2023

"Accelerator"

Amazon Web Services

AWS Global Fintech Accelerator programme

2023

Startups' Top 100 Startups List

Ranked #23

2023

Best B2B/B2C Banking Initiative

Pay360 Awards

2022

Best B2B/B2C Company

South Summit Awards

2021