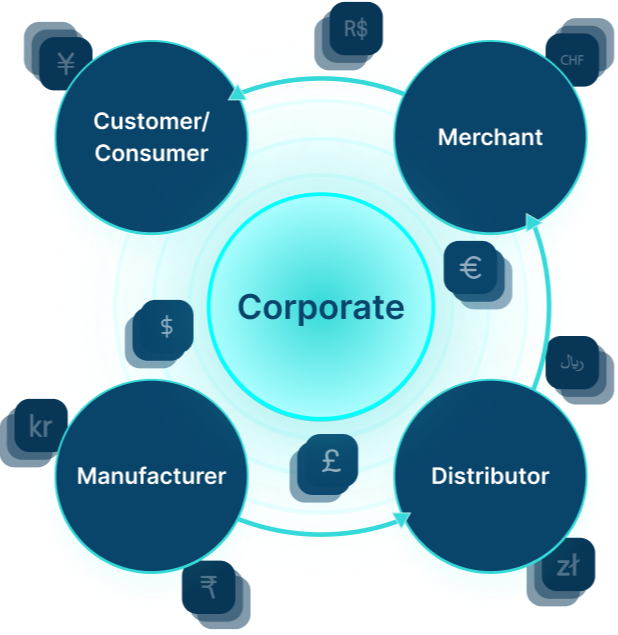

Power your distribution network

Bring together your financial partners, distributors, and merchants onto Toqio's financial orchestration SaaS platform. Build the tailored financial products and merchant propositions you need in your brand to unlock growth, drive efficiencies and set your business apart. You’re in control.

Proud to be working with:

Unlock revenue streams

Offer monetization and growth opportunities at the point of need to drive higher merchant retention and strengthen your supply chain.

Drive a better experience

Bolster your merchant relationships by offering exclusive, premier financial services.

Tap into better offerings

Unbundle existing products and reconfigure them into new value propositions you can easily take to your merchants.

Access enhanced data

Use financial and non-financial data for a comprehensive view of your merchant network. Help top performers grow and laggards thrive.

Embedded finance gains

Offer tailored financial services integrated into your supply chain ecosystem to supercharge your business. These services, commercially linked to existing offerings, provide new and ongoing value drivers that increase spend and investment with your brand.

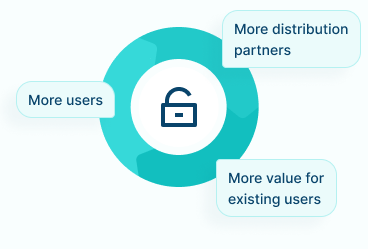

Maximize network value

- Accelerated capacity extension for service

- Enable connectivity to multiple providers

- Enhance offerings with a wider selection of products and faster access

Increase sales, lower costs

- Drive process efficiencies

- Enable banking, lending, and payment automation

- Provide flexibility and choice on more offerings

Strengthen brand impact

- Make services more convenient and incentive-based

- Increase your share of wallet-lock-ins, reward programmes, flexible terms

- Allow for branded, platform-driven experiences

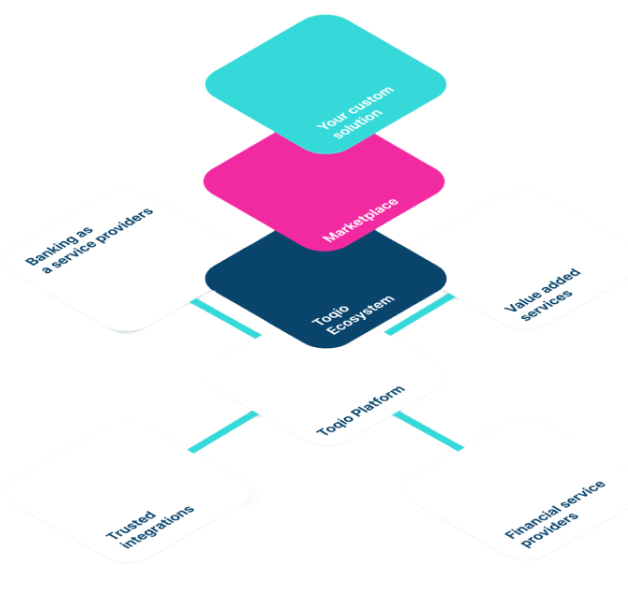

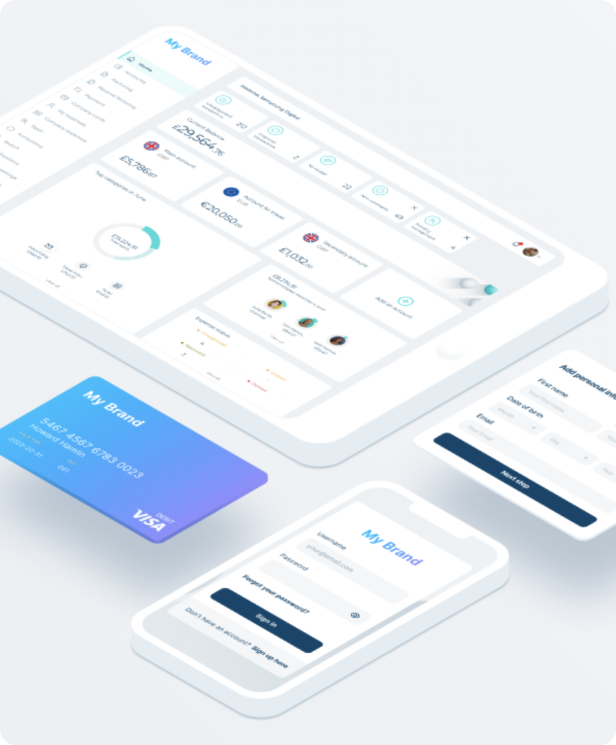

The Toqio platform as your growth accelerator

Toqio offers powerful, user-friendly financial tools and products through a global network of banks and financial partners. Enhance your core offerings or create new financial channels for shared value.

Our automated finance orchestration platform drives growth, operational efficiency, and supply chain resilience, helping you outmanoeuvre the competition.

8% uplift

New customer acquisition

2x increase

Repeat order value

3x savings

Time to market

How it works

Financial institutions want to lend to all businesses but need reliable data to trust SMEs. Leverage your brand strength, extensive merchant data, and industry knowledge to change the game.

Position yourself as the preferred partner and financial service delivery channel for your merchants, gaining enhanced control, visibility, and connectivity. Unite commercially-linked financial partners, distributors, and your brand on one platform then offer data-driven financial experiences.

Enhance your existing offerings for partners or create bespoke marketplaces to unlock new revenue streams. Take control of your network.

Launch faster with a fully configurable platform that's easy to change and manage

Go from concept to market in as little as eight weeks. Everyday banking or bespoke financial services are commercially linked to your existing offerings on a branded, compliant platform tailored to your needs.

Configuration first

Our low code/no-code platform lets you effortlessly design business processes, no matter how complex they are. Use existing drag-and-drop modules or build your own, we’re novice-friendly.

Cloud-native and API driven

The Toqio platform offers a resilient, scalable architecture with bank-grade security and full regulatory compliance. It’s all built in.

The platform as aggregator

Connect to a robust network of reputable third-party financial service and non-financial service providers, all of whom are fully compliant.

Everything you need in one place

Build tailored, frictionless, and personalized finance journeys designed for your industry.

Access everyday banking and specialized financial services to embed solutions where and when needed.

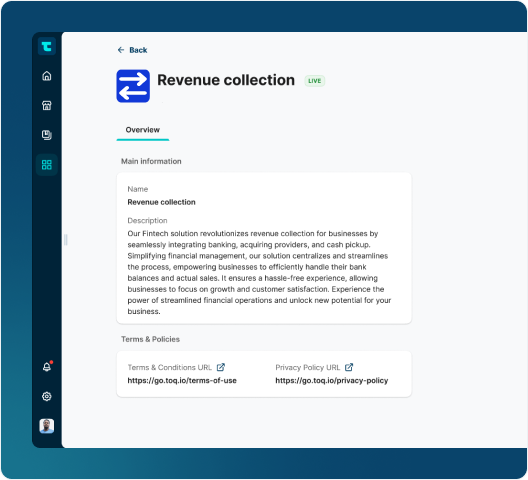

Our solutions

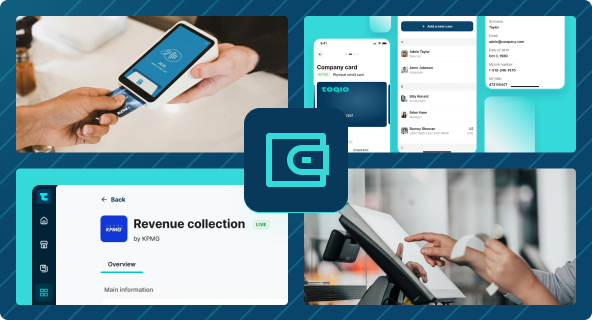

- Card acquiring

- Cash collection

- Direct debit

Revenue collections

Automate, streamline and unify all your merchant revenue workflows and eliminate complex payment challenges at any stage. View point-of-sale, account to account transfers, digital cash, and direct debit collections on a single platform and get the data you need to understand what’s being sold where and when.

- Cards

- Digital wallets

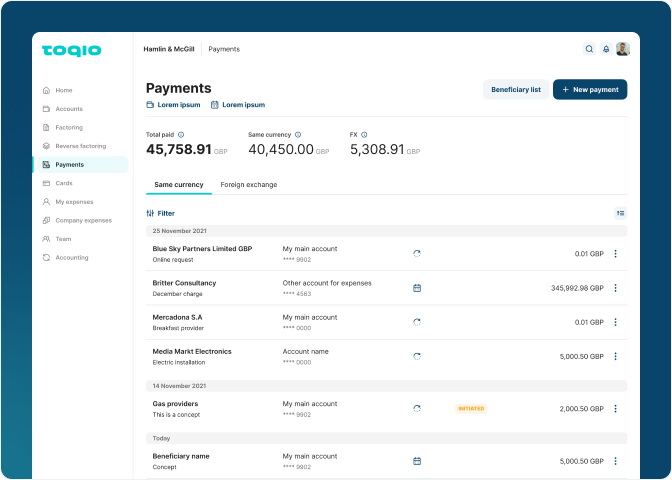

- Payment orchestration

- Bank accounts

Cash distribution

Distribute cash digitally via topped up cards, digital wallets with control over spending limits, currencies and more. Gain a holistic view of spend with consolidated tracking on our platform.

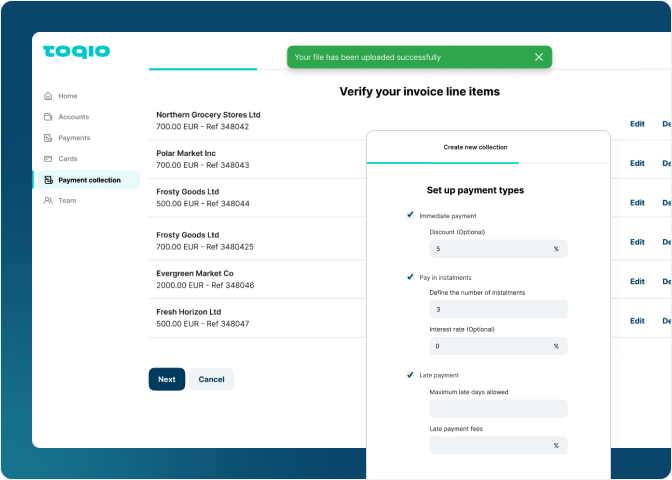

- Invoice processing

- Invoice reconciliation

- Expense management

Payment automation and reconciliation

Streamline your distribution network's payment processes by connecting your ERP directly to our platform, automating payment notifications and collections. Our payment rules engine enables bulk collections 30-, 60-, or 90-day flexible terms, offering merchants payment options for a fee or discount. Automate due and overdue reminders with branded messages across multiple channels to reduce administrative load.

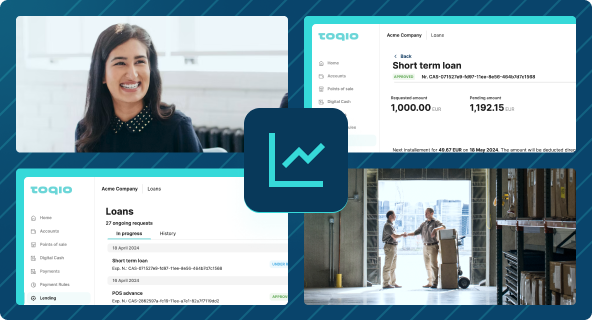

- Merchant cash advance

- Invoice financing

- Asset financing

- Growth financing

- Commercial mortgage

Liquidity through lending

Unlock financial flexibility with access to cash advances and short-term loans using your data. Automate loan repayments and PoS splits within your branded platform. Enjoy flexible lending from your balance sheet(optional) or third-party lenders. Incentivize long-term commitments with competitive lending terms.

Make better informed decisions

Unlock deep data insights on your merchants from a single platform to boost productivity, performance, and growth efforts. Integrate your existing systems with Toqio to centralize financial, business intelligence, and ERP data for better planning. Gain visibility on distribution performance, sales figures, and financial health.

Merchant propositions

Combine financial and non-financial data to develop targeted financial products, like growth capital for top performers. Commercially link products for unified experiences and new opportunities.

Credit insights

Leverage merchant inventory and revenue data to help financial service providers improve credit assessments and maximize product distribution.

Distribution network health

Understand financial exposure across all lending products to align corporate and third-party capital with growth goals.

Future-proof your business and ecosystem

Create ongoing value drivers on our platform and get your customers and suppliers to spend and invest more with you.

Core revenue uplift*

Drive repeat orders and higher order values with your merchants and increase your share of wallet. Access superior products and multiple tier 1 banking and BaaS providers.

- Automated payables

- Automated receivables

- Flexible payment terms

5-8%

Revenue uplift

New revenue streams*

Simplify your access to premier financial products and solve for key reconciliation and automation challenges on payables and receivables.

Create new marketplaces across payments, lending, and revenue share.

- New billing revenue

- Revenue share

5-7%

Unrealized revenue

Lower costs*

Tap into a robust network of reputable third party providers and save up to 8% on cost of capital, as well as reduced administrative and payment fees.

- Cost of capital

- Interchange and payment fees

- Reconciliation

6-8%

Cost savings

What we solve

Working capital for your SME distributors and merchants

Automated digital financing solutions, such as receivables finance, asset-based lending, merchant cash advance, growth financing, and invoice financing, swiftly address short-term cash flow needs.

Key benefits

- Increased loyalty/retention

- Preferred access

- Increased revenue

Liquidity optimization throughout your distribution network

Automated invoice and revenue collections streamline cash conversion cycles, enhancing control and visibility for improved planning.

Key benefits

- Improved experience

- New revenue streams

- Cost reduction

- Cash flow optimization

Key industry examples

Every organization is unique, with varying needs. Discover how we help you optimize opportunities wherever and whenever required.

New customer retention strategy: Food and beverage

A European brewery embarks upon a new customer retention strategy.

Member engagement: Pharmaceutical distribution

A large Spanish cooperative seeks to engage more with its members.

Retail

Streamline operational efficiencies at the store and regional levels with third-party banking services.

Franchise

Unify your merchant network on a single platform and create more flexibility for payments.

FMCG / Food / Bev

Streamline operational efficiencies at the store and regional levels with third-party banking services.

Take your supply chain distribution to the next level with Toqio

An all-inclusive financial service orchestration platform built for corporates looking to grow, drive efficiency, and foster supply chain resilience through embedded finance solutions. Enquire now!

Toqio knows embedded finance

Explore our latest content or tune in to our podcast series

Podcast

Listen to our embedded finance podcast

Toqio hosts a podcast called "Embedded in the Market". Every fortnight, we speak to acclaimed guests who are deep in the embedded finance trenches.

Blogs

Explore our views about embedded finance today

Every month, we publish a number of articles on corporate embedded finance, explaining the ins and outs of the concept, how it works, and what's going on in the market.

About Toqio

Toqio gives corporates access to financial tools that transform the value of their distribution networks for growth, efficiency, and resilience. We’re not turning corporates into banks, just enabling them to become the nexus between their merchants and financial institutions looking for new opportunities, unblocking the flow of capital, improving liquidity, and creating new and ownable financial channels in their networks.

We believe that with the right partner, corporates can tap the full potential of embedded finance on a fully configurable orchestration platform, harnessing the massive possibilities for growth lying dormant in their merchant networks.

*These valuations are provided for information purposes only as they may vary from business to business. They are merely indicative and do not constitute an offer, or the solicitation of an offer, to initiate or conclude any transaction at the value stated.

Inducted into the Visa Innovation Program Europe

2024

Oracle NetSuite Rising Star

Deloitte UK Technology Fast 50 Award

2023

"Accelerator"

Amazon Web Services

AWS Global Fintech Accelerator programme

2023

Startups' Top 100 Startups List

Ranked #23

2023

Best B2B/B2C Banking Initiative

Pay360 Awards

2022

Best B2B/B2C Company

South Summit Awards

2021