Embedded finance solutions

for corporations that want to incorporate banking, lending, and more into their merchant networks.

The challenge

For years, a major European beverage company, with an annual turnover of EUR 1.5 billion, had engaged in the practice of fostering the loyalty of bar and restaurant owners by offering branded furniture and financial guarantees with banks in exchange for a commitment to purchase. In recent years, however, “branded bars” have fallen out of fashion and financial guarantees were taken over by the bank's direct relationship with the client after the first year.

Merchant success equals Brewery success

In the Brewery's contained market (hospitality operators in Spain), the greatest opportunity for growth seemed to lie in revenue expansion with existing clients and retaining top performers. To achieve this, the Brewery was looking to foster a deeply loyal relationship with its client base.

Commercial lock-in

Without a barrier to exit there can be no genuine exclusivity. The Brewery was clear on the fact that it wanted to deliver meaningful value to its clients, but it also needed to ensure that exclusivity was not going to put its clients' investments at risk. Hence, the Brewery required a platform where merchants would be satisfied with a high level of service (of benefit to the merchants) while driving a high level of commitment (of benefit to the brewery).

Financial service disintermediation

The Brewery possesses significant amounts of historical data on all its clients: purchase volumes, payment histories, growth trajectories, and more. Market knowledge and client data have de-risked its clients for the purposes of lending. It wanted to own the client relationship and not pass information off to third parties.

How Toqio has helped

Revenue uplift

Simple intuitive journeys for merchants can drive 30%+ higher gross merchandise value (GMV) due to an increase in repeat transactions. One Toqio customer saw a 45% increase in approval rates in the first 12 months. In the case of the Brewery, points of sale linked to bank accounts embedded in supply chain systems are already driving higher GMV and more repeat orders. Bar employees who can place orders use associated cards (with limits) for agile and autonomous decision making.

Loyalty and retention

The Brewery has become a “one stop shop” that helps merchants succeed. Cash flow is visible across end customer payments (digital cash and PoS terminals). The company plans to offer financing to bars by offering alternate propositions (such as debt funds) that provide lending and payment term flexibility. Part of this structured success is ensuring that the onboarding process for merchants is simple and easy to comprehend, it can eliminate a lot of friction and uncertainty. One Toqio customer noticed a 50% increase in average order value when they started onboarding their merchants via the Toqio platform. Once customers are comfortable with a tool, they tend not to want to switch. Of course, that tool has to provide value, as well.

Holistic availability of data

With access to real data on consumer spending habits (at the bars), bar balance sheets (accounts, payment data), and more, the Brewery can now compare that data with non-financial information, including order history and consumption rates to create hyper-personalized financial proposals for their merchants.

The tools employed

Banking products

By offering accounts, cards, lending, and more through new or existing channels, a company can replace volume discounts with upfront cash payments structured as loans, thereby fostering long-term merchant retention.

Points of sale

A company can provide point of sale (PoS) and acquiring solutions, providing merchants easier access to finance solutions like cash advances. In the meantime, the company obtains better data and can leverage soft lock-in mechanisms.

Access to top tier lenders

With better data and a wide distribution network in play, a company can attract top-tier lenders, which can then be a part of a hyper-personalized offering to business partners, allowing the merchant ecosystem to grow and expand.

How you can make the most of embedded finance

-

Leveraging vastly improved digital capabilities to acquire new merchants and retain high-performers.

-

Putting financial products in play to create lock-in mechanisms, reducing merchant churn.

-

Increasing revenue per merchant by making data-driven decisions that help them grow.

-

Providing support to top performing merchants so they can expand to new locations or markets.

-

Creating a safe and useful merchant network where everybody derives benefit from the interconnectedness.

Why Toqio?

Build financial products not available from high-street banks and offer hyper-personalized solutions to your merchant network

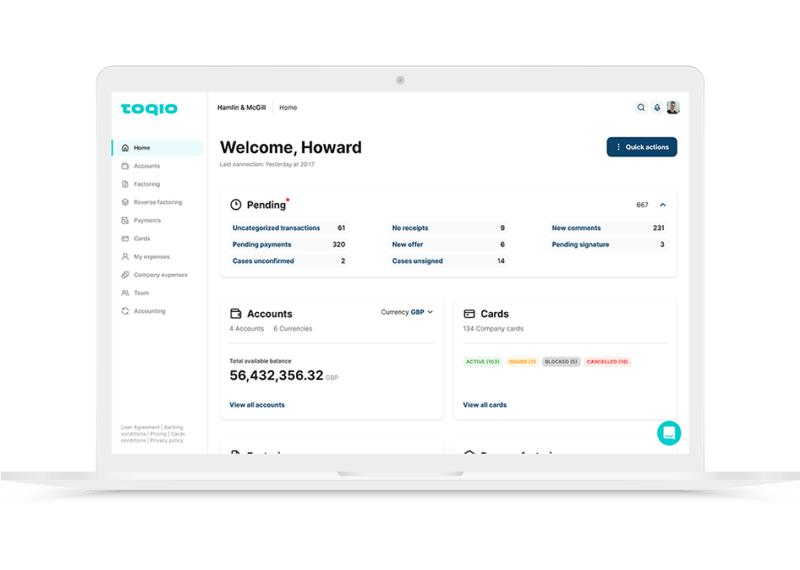

Built with your needs in mind

The market today is extremely competitive, especially with regard to tangible products in the FMCG or food and beverage spaces. Toqio was built to assist you in becoming an industry leader by offering your merchant network a suite of banking solutions that are hyper-personalized, according to the needs of your merchants.

You aren't tied to one provider

Toqio is agnostic in terms of service providers. That enables our customers to offer bank accounts, financing, payments, cards, and many other financial products from whomever they prefer. It's also a great mechanism for empowering your company with the clout it needs to negotiate premium service rates.

Totally customizable

Launch a fully branded mobile app or website, including intuitive interfaces for users, administrators, and other stakeholders. With nearly 400 interconnected, fully customizable UI elements, Toqio offers one of the most flexible development platforms on the market.

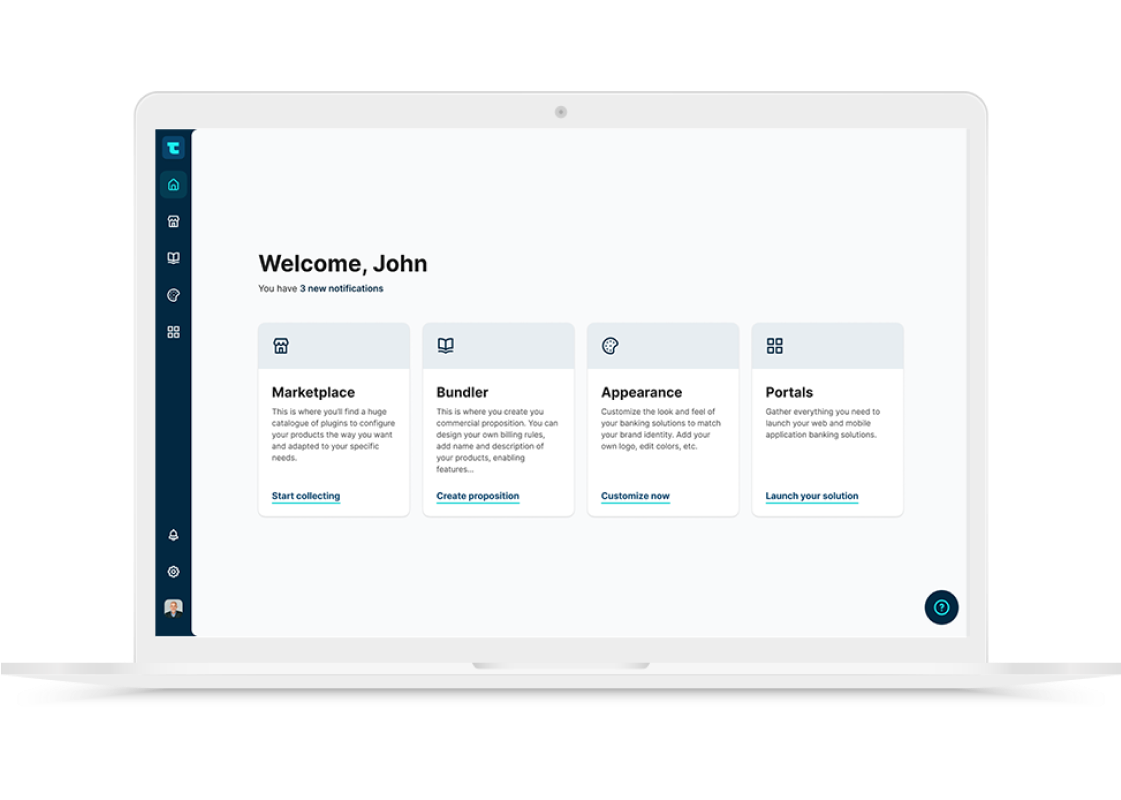

A comprehensive Marketplace of reputable providers

Select the features you need for your customers in our Marketplace. Include modules related to compliance, KTC/KYB, analytics, credit, and many, many others. If you decide to build your own unique module, put it on our Marketplace for others to use and enjoy a new revenue stream.

Unprecedented insights based on your business ecosystem

Our proprietary platform model enables you to gather financial and non-financial information, then analyze it in depth. Chart a business course based on empirical data, not supposition.

Embedded finance resources

Would you like to know more about embedded finance? Here are some links we think might come in handy.

Listen to our embedded finance podcast

Toqio sponsors a podcast entitled "Embedded in the Market". Every fortnight, we speak to acclaimed guests who are deep in the trenches.