The Future of SME Finance Is Distribution and Banks That Embrace It Win.

Smart finance leaders are scaling faster by transforming corporates into distribution allies.

Here’s how they’re doing it:

-

Lowering SME acquisition costs by tapping into existing corporate ecosystems and leveraging richer, real-time data.

-

Reduce credit risk and boost decision accuracy by leveraging richer, real-time data, contextual insights, and trusted relationship signals.

-

Offering tailored financial products at scale—from accounts to cards to lending—through embedded, always-on distribution channels.

A new essential channel for banks and financial institutions?

Banks and FIs face daily challenges that include legacy systems, fragmented product offerings, and growing expectations from digitally native customers and partners. These problems can strain internal teams, stall innovation, and reduces customer loyalty.

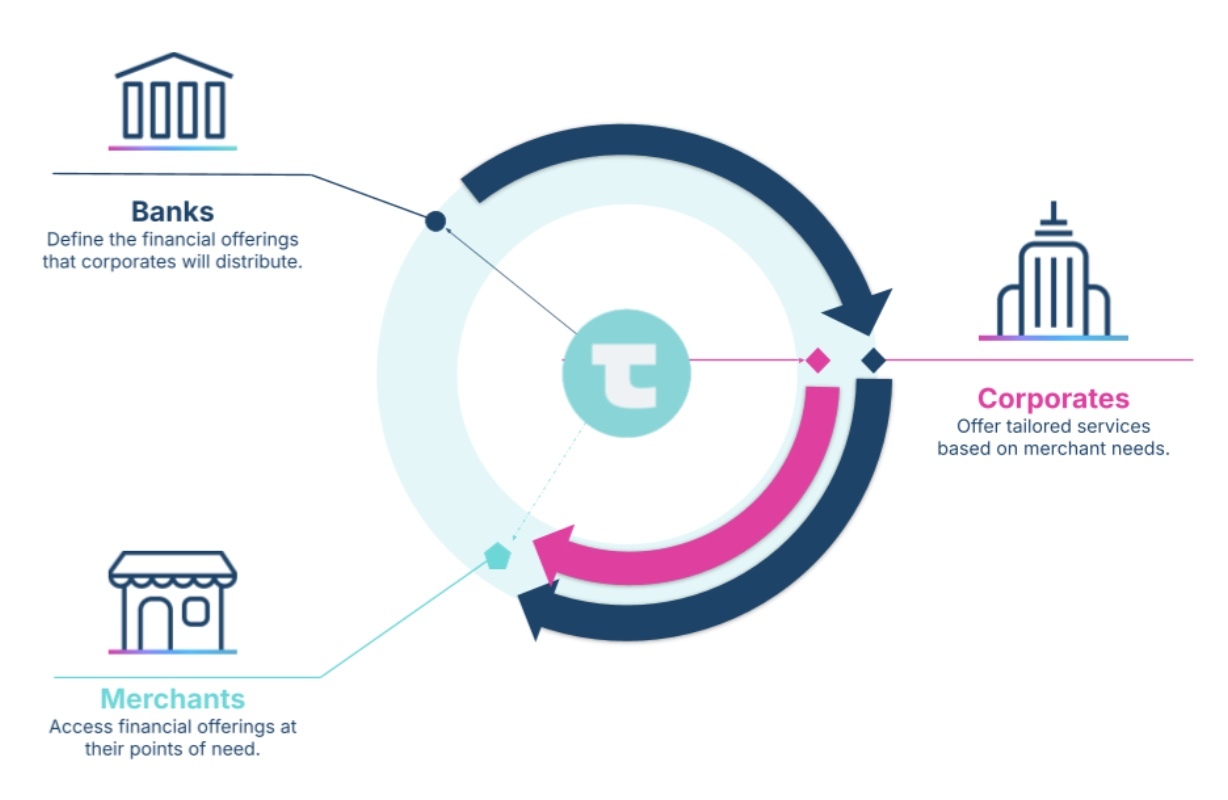

Embedded Finances enables a structural shift in financial service distribution: the corporate becomes "Agent 2.0", the new primary channel through which financial services reach end customers.

Banks and fintechs can thus empower their corporate clients to embed contextual, sector-specific financial solutions into their offerings, creating powerful new value for SME customers.

Whether your goal is to deepen relationships with SMEs, build new digital channels, or future-proof your platform strategy, embedded finance gives you the infrastructure to scale, differentiate, and lead.

Leverage on your corporates to get to your SMEs.

What can embedded finance do for banks?

Turn inefficiency into margin

Only 48% of cost-saving targets are currently met1. Why? Manual invoicing, scattered data, and outdated banking processes. Embedded finance automates reconciliation, integrates payments into your ERP, and helps reduce days sales outstanding (DSO).

Result: Fewer errors, fewer delays, more time to focus on growth.

1 Boston Consulting Group, 2025 "The Future of Fintech"

Leveraging Embedded Finance Readiness

41% of financial institutions have adopted embedded

finance, and 48% are expanding BaaS capabilities2.

Result: With growing supplier readiness, financial institutions can partner with corporates to launch embedded finance solutions.

2 PYMNTS 2024 "Embedded Finance and BaaS: From Marketing Buzz to Banking Bedrock"

Leverage your corporate network as Agent 2.0

A structural shift is happening in financial services and distribution: Corporations become "Agent 2.0", the new primary channel through which financial services reach end customers.

Result: Banks and fintechs improve working capital by accessing a large network of potential SMEs customers, which they otherwise would not be able to.

*

Embedded finance benefits everyone involved

Watch this quick video to discover how.

The numbers behind the need.

50% of corporates3 struggle with trapped liquidity

Easing working capital constraints can help stimulate revenue growth.

How can this be addressed

Embedded finance can streamline payment collections and inter-account transfers, including cross-border transactions. That means smoother reconciliations, improved cash flow, and more efficiently managed global transactions.

3. Citi 2025 "Supply Chain Financing report"

47% of SMEs4 are willing to pay for better finance solutions

SMEs are shifting away from traditional banks and looking to corporates for smarter financial solutions.

How can this be addressed

Working capital loans are a great way to provide merchants with the services they need, using sales figures or order volume as the basis for approval.

4. Accenture 2024, “Embedded finance: transforming financing for SMEs"

Case studies

European brewery embarks upon new customer retention strategy

Learn how a customer launched a solution built on Toqio in just 16 weeks!

International logistics company optimizes liquidity in its distributor network

We provided help accessing liquidity to manage complex international financial relationships.

Embedded finance gains

Embedded finance is more than an efficiency play, it’s a growth tool.

Future proof your business and ecosystem

Create ongoing value drivers on our platform and get your customers and suppliers to spend and invest more with you.

Core revenue uplift*

Drive repeat and higher order values with your merchants and increase your share of wallet with access to superior products and multiple tier 1 bank and BaaS providers.

- Automated payables

- Automated receivables

- Flexible payment terms

5-8%

Revenue uplift

Core revenue uplift*

Drive repeat and higher order values with your merchants and increase your share of wallet with access to superior products and multiple tier 1 bank and BaaS providers.

- Automated payables

- Automated receivables

- Flexible payment terms

5-8%

Revenue uplift

Core revenue uplift*

Drive repeat and higher order values with your merchants and increase your share of wallet with access to superior products and multiple tier 1 bank and BaaS providers.

- Automated payables

- Automated receivables

- Flexible payment terms

5-8%

Revenue uplift

Here are some useful articles.

Learn more about embedded finance and how it can take your business ecosystem to a whole new level.

Let's build what your network needs

The Banking business isn’t just about selling your product anymore, it’s about enabling your merchants to succeed. Let us help you create the financial tools they’ll thank you for.